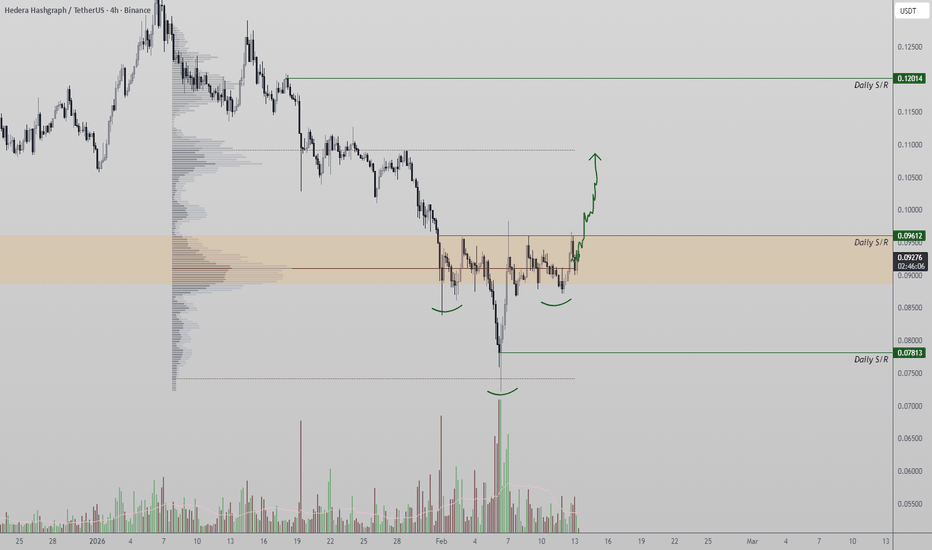

HBAR Head and Shoulders indicate Trend Reversal HBAR price action is beginning to form a constructive reversal pattern on the intraday timeframe, with an inverse head and shoulders structure taking shape. The formation is developing around the value area low, which has acted as the base of the structure and helped establish the left shoulder, head, and right shoulder sequence. This behavior suggests that downside momentum is weakening and buyers are gradually stepping in.

From a technical perspective, the most important level to monitor is the neckline resistance, which aligns with the daily resistance near $0.09. This level has capped price action on multiple attempts and represents the trigger point for confirmation of the inverse head and shoulders pattern. As long as price remains below this neckline, the structure remains unconfirmed and consolidation may continue.

For the bullish scenario to activate, HBAR needs to break and hold above $0.09 with a clear bullish influx. Ideally, this breakout should be accompanied by strong bullish engulfing candles and expanding volume, signaling aggressive demand. If confirmed, the pattern projects an upside target toward the next daily resistance near $0.12.

From a price action and market structure perspective, holding above the value area low keeps the reversal thesis intact. A successful neckline breakout would mark a shift in intraday structure and open the door for a rotational move higher.

What traders are saying

Hedera hits bottom —The start of a new bullish cycleHedera's bullish reversal is now confirmed and something beautiful is about to happen. Something good is happening now and just in the process of transformation to something great.

HBARUSDT is about to embark on the strongest rise since June 2025, more than 8 months ago.

The target shown on this chart is an easy one, high probability; can be approached with 5X for more than 555% total profits potential within 30 days. Can it get any better than that? I doubt it can.

The first bullish move since June 2025 and the shape and size should be very similar.

I am focusing on the short-term, the next 30 days, because the market is mixed in so many ways. We are all confused as to what will happen mid- to long-term.

My idea is not confused though, my thinking is clear. The bear market is over for most of the altcoins. Only a few projects might go on to produce lower lows in the latter part of 2026. Most of the market already hit bottom, which means long-term growth.

That's the conclusion in plain simple language.

The prices that are available now are the best ever in many cases or the best in 4, 5 or even 6 years.

Some indicators flashed signals that were unseen for an entire decade. Something amazing is happening. The worst ever as usual transforms. Crisis turns into opportunity. The bear market bottom is the start of a bull market. The extreme fear market sentiment is the start of a transition towards euphoria and greed.

It will take a while. It takes time; but, if you are reading this, it is still early. If you are reading this, you are a full time Cryptocurrency enthusiast because the truth is that right now everybody is gone.

It won't stay like this for too long.

When Bitcoin moves above $80,000, people will start to wake up.

When Bitcoin moves above $90,000, excitement will build up.

When Bitcoin challenges $100,000, everybody will start to buy based on FOMO.

When everybody is buying and excited, a correction comes.

It is better to enter now, to buy now; join now as prices are low. When prices are high, risk becomes high; swings, shakeouts and so on. It simply becomes hard to hold.

If you manage to enter now, you can win/profit regardless of what happens next, because the bottom will not be challenged for months, if ever.

Thank you for reading.

Namaste.

$HBARUSDT Chart Analysis (4H Timeframe)The chart shows BINANCE:HBARUSDT forming a bullish continuation setup after a strong breakout, with price now retesting a key demand zone for potential upward expansion.

📊 Market Structure

Price recently broke above a consolidation range with strong bullish momentum.

The breakout created a Fair Value Gap (FVG) + buying breaker block at $0.09887 – $0.09712, acting as a key demand zone.

Current price action suggests a pullback into support before the next bullish move.

🟢 Key Support (Demand Zone)

$0.09887 – $0.09712 → FVG + breaker block support.

Buyers expected to defend this zone.

Holding above this area keeps bullish structure intact.

⚡ Trade Bias: Bullish Continuation Setup

Entry Area: ~$0.09891 (buy on pullback confirmation)

Stop Loss: ~$0.09590 (below demand zone invalidation)

🎯 Upside Targets

Target 1: $0.10450 → Immediate resistance level.

Target 2: $0.11090 → Major supply / next liquidity zone.

📈 Technical Outlook

Strong impulsive breakout shows increasing buying pressure.

Demand zone retest supports continuation probability.

Higher lows formation signals strengthening bullish trend.

✅ Summary: BINANCE:HBARUSDT remains bullish while holding above the $0.097 support zone. A successful retest could push price toward $0.104 and $0.111 levels. Breakdown below $0.0959 would invalidate the bullish setup.

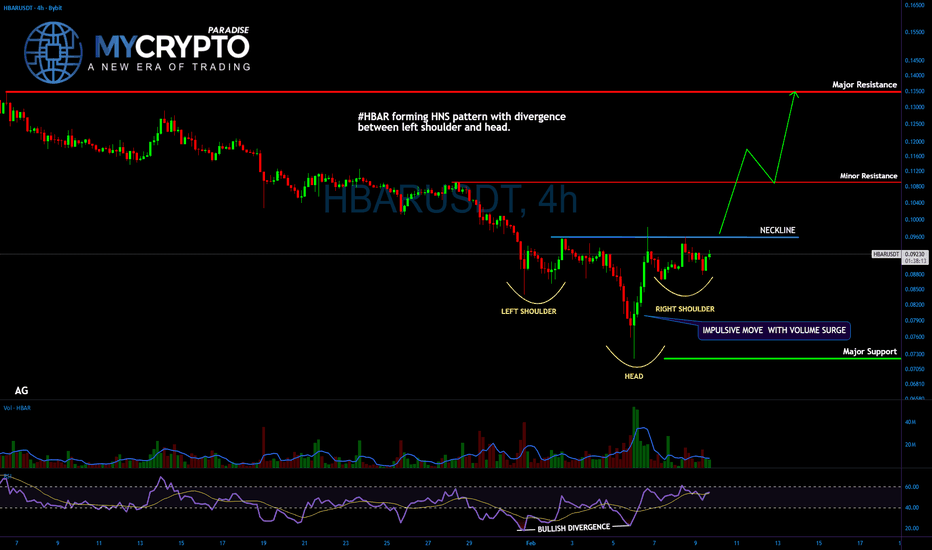

#HBAR—This HNS Structure Rarely Fails After Liquidity Is Taken

Yello Paradisers! -Are you noticing how HBAR is quietly setting a trap after taking liquidity exactly where most traders panicked and sold, and could this be the moment when patience finally pays off?

💎#HBAR forming a clean inverse head and shoulders pattern right at a previous support zone, which is a classic professional accumulation behavior. Before this structure started to develop, price deliberately swept liquidity below support, forcing out weak hands and triggering stop losses from inexperienced traders. This is exactly the type of environment where smart money likes to build positions.

💎After the liquidity sweep, we saw a sharp bullish impulse accompanied by strong volume. This move was crucial because it broke above the previous swing high of the left shoulder, which also aligned perfectly with horizontal resistance acting as the neckline. This is a strong technical confirmation that buyers are stepping in with conviction, not randomly.

💎At the moment, #HBAR is forming the right shoulder. What is important here is not speed but quality. Price is consolidating tightly while volume is clearly declining. This is a healthy sign, as it signals an absence of aggressive sellers. When price holds near the neckline without heavy selling pressure, it usually increases the probability of continuation to the upside rather than a breakdown.

💎The RSI already gave us an early warning signal. A bullish divergence formed between the left shoulder and the head, showing that downside momentum was weakening even while price was still moving lower. This divergence often appears before trend reversals and is another reason why this structure deserves close attention.

💎Another key detail is the neckline behavior itself. This level has already been tested three times, and each test weakens the ability of sellers to defend it. Repeated tests usually favor a breakout rather than rejection, especially when combined with declining volume during consolidation.

💎From a level perspective, major support is located around the 0.072 area. As long as the price holds above this zone, the bullish structure remains valid. On the upside, the major resistance sits near 0.135, with an intermediate resistance around 0.110 that may cause short-term reactions.

That's why Paradisers, we are playing it safe and focusing only on high-probability structures like this one. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you will make it far in your crypto trading journey and get inside the winner circle.

MyCryptoParadise

iFeel the success🌴

HBAR/USDT - Falling Channel, Breakout or Bearish Continuation?On the 1D timeframe, HBAR/USDT is still under medium-term bearish pressure. Price has been moving consistently inside a descending / falling channel since the previous peak, indicating that sellers remain dominant.

The market structure shows:

Lower Highs

Lower Lows

Rejections at the upper trendline

Currently, price is testing the channel resistance along with a horizontal resistance zone, making this a crucial decision area for the next move.

---

Pattern Explanation

The main pattern visible on the chart is a:

Falling Channel / Descending Channel

Key characteristics:

1. Two parallel downward trendlines

Upper trendline = Dynamic Resistance

Lower trendline = Dynamic Support

2. Repeated price bounces within the channel

3. Volume tends to weaken on rallies and increase on drops → distribution indication

Theoretically:

A Falling Channel can act as a bullish reversal pattern if an upside breakout occurs

Until breakout happens → it remains a bearish continuation structure

---

Key Levels

Layered Resistances

0.10500 → Minor resistance / latest rejection

0.11550 → Horizontal resistance

0.13049 → Mid resistance

0.14850 → Major resistance

0.16200

0.19400 → Macro key resistance

Supports

0.08850 → Near-term support / temporary base

Channel lower trendline

0.07229 → Previous swing low / extreme support

---

Bullish Scenario

Bullish confirmation requires a channel + resistance breakout.

Flow scenario:

1. Price breaks above the falling channel upper trendline

2. Daily candle closes above 0.10500

3. Successful retest turns resistance into support

Upside targets:

0.11550

0.13049

0.14850

0.16200

0.19400 (major target)

This move would likely be supported by:

Volume expansion

Broader crypto market strength

Weakening BTC dominance

A valid breakout could shift structure from bearish to sideways or bullish reversal.

---

Bearish Scenario

If breakout fails, the channel remains a bearish continuation pattern.

Bearish confirmations:

1. Rejection at the upper trendline

2. Failure to hold above 0.10500

3. Breakdown below 0.08850

Downside targets:

Mid-channel support

Lower channel trendline

0.07229

If the lower support breaks → potential:

Capitulation wick

New lower low

Deeper bearish continuation

---

Conclusion

HBAR/USDT is currently at a key decision zone.

Channel breakout → upside reversal potential

Rejection → continuation to the downside

As long as price remains inside the falling channel, the bias stays bearish-to-neutral.

Traders should wait for:

Breakout confirmation for long positions

Clear rejection for short positions

Key level discipline remains essential.

#HBAR #HBARUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoins #CryptoTrading #FallingChannel #BearishTrend #BullishBreakout #SupportResistance #ChartPattern #CryptoMarket #PriceAction #TrendAnalysis

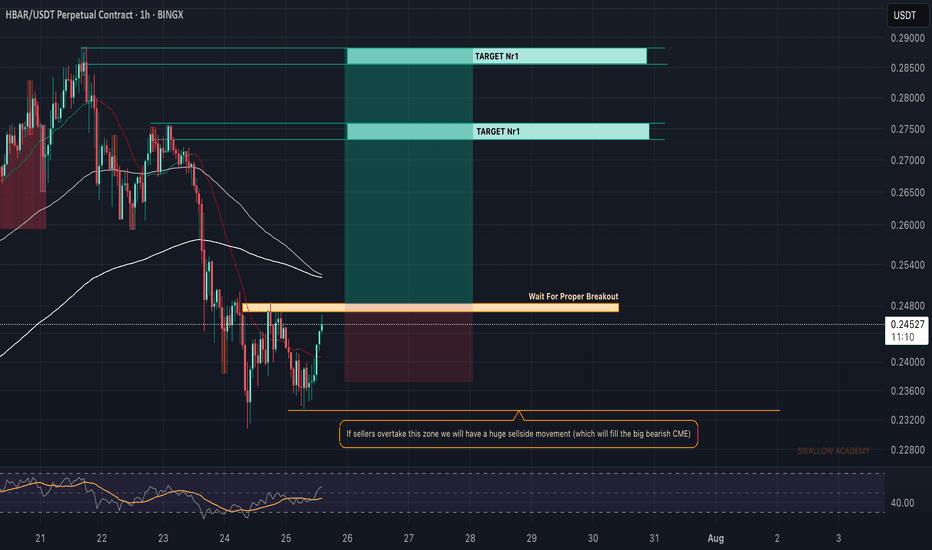

Hedera (HBAR): Sellers Are Dominating Current ZonesHBAR is cooked, at least for now, while the price stays below the major resistance zone, which sellers have secured fully.

Despite the sell-side view we are seeing on the HBAR, we are also seeing a smaller recovery happening, which most likely would lead the price to the $0.105 area.

So we're expecting a smaller bounce here but the bigger picture is clear for us: we should keep moving down from here!

Swallow Academy

hbarusdt longAttention followers!

Attention followers!

hbarusdt long

Entry point: yellow

SL: red

Take profit: black

Hello dear followers.

I'd like to point out that I primarily trade with 20x leverage, and my tp1 (Target 1) is placed 2.5% from the entry point and 2.5% from each other.

I'd also like to point out that my stop-loss (SL) is also 2.5% from the entry point.

Therefore, we will lose 50% of our margin if the stop-loss is triggered, and we will gain 50% at tp1 (Target 1), 100% at tp2 (Target 2), and 150% at tp3 (Target 3) if the trade is successful.

Invest what you can afford to lose, which is between 1% and 5% of your margin.

Thank you.

$HBAR 4H CHART UPDATE

📌 CRYPTOCAP:HBAR is forming a Head & Shoulder pattern on the 4H chart, which I already marked earlier ✅

📌 Left shoulder and Head are already done. Now price is working on the right shoulder ✅

📌 For this setup to stay valid, price must hold the green support zone below ✅

📌 If this support holds well, then we can expect a bounce and upside move from here ✅

📌 Final view: Support hold = bullish chance, support break = pattern fails 🔥

$HBAR Hedera buying opportunity ? CRYPTOCAP:HBAR is sitting in the wholesale zone 0.091–0.192 with the line in the sand at 0.041; the next real supply is 0.30–0.40, then 0.619.

Hedera is already live and built like infrastructure: production-grade services for tokens, smart contracts, and verifiable event ordering, with a design emphasis on predictable costs via stable-fee thinking and steady upgrades instead of hype-driven shipping.

The credibility signal is its governance model, built around a rotating council of large organizations, which prioritizes continuity and real-world adoption.

In practice, it’s most compelling for use-cases that need low, predictable fees and reliable proof of what happened and when audit trails, compliance logs, and supply chain style records rather than meme-first speculation.

If the long-term thesis holds, it’s because consistent execution, durable utility, and adoption that survives when the excitement fades.

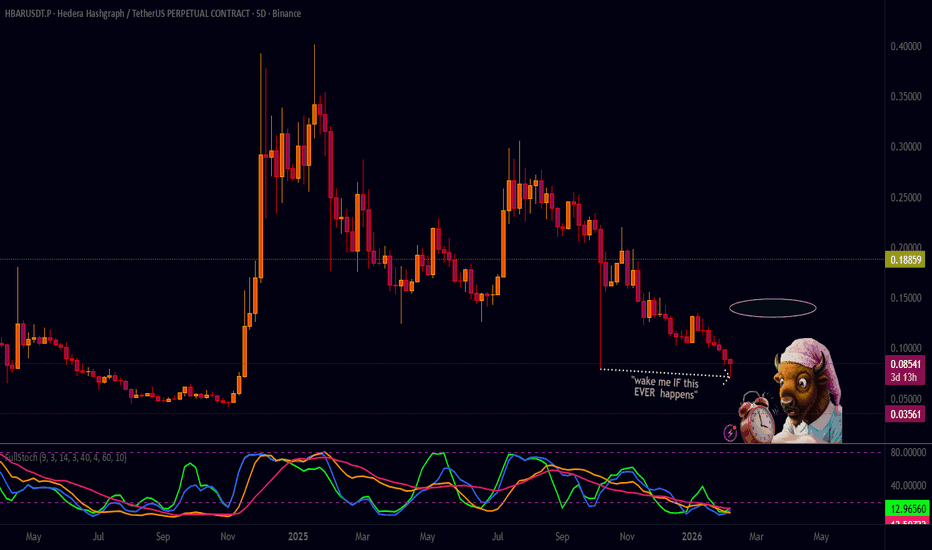

Hedera enters bullish reversal zoneHedera went below the flush, October 2025, and hit the lowest price since November 2024. As soon as this happens two things happen: 1) There is a recovery back above the flush low and 2) we get high volume on the lower low and recovery candle.

The second part of this signal, the high volume and lower low candle closing green, is what reveals the end of the down-move, potentially.

Notice that the action is happening within a falling wedge pattern. Sooner or later, this always leads to a bullish breakout. The stronger the crash, the stronger the reversal that follows.

Ok, so the market will turn bullish but the tricky part is to know how high it will go. It is hard because we are getting a relief rally but there is no limit to how strong this relief rally will be.

For example, if bullish action is present for two months, lots can happen in this time window and this opens up the previous high around July 2025 as the next target. More than 235%.

A weaker relief can end at $0.21 with 135% profits potential. This can happen within weeks or days, an entire month is not needed.

It is possible we get a move similar to November 2024 and this would mean the higher target, but it is too early for me to say. I haven't seen any of the big projects moving in 2026 so we have nothing to go by.

Your guess is as good as mine as to how far prices can go but, I can say that we are definitely looking at a good bullish reversal zone.

Namaste.

The Great Awakening?😴🚀

After a brutal 194-day slumber and a 76% drawdown, Hedera (HBAR) is finally showing signs of life right at the "Wake me up" support level. We are currently seeing a confluence of bottoming signals that suggest the macro trend might finally be shifting.

The Plan:

Entry: Daily candle close above 0.085.

Target 1: 0.115 (Previous structure resistance).

Target 2: 0.140 (The "Hope" zone).

Invalidation: A break back below the recent wick at 0.071.

Patience pays. The alarm is finally going off—are you waking up or hitting snooze?

Hedera: bounce or trap? key levels and targets for the days aheaHedera Hashgraph. Who else just watched that crazy liquidation wick and thought: "ok, someone big just hit the panic button"? After the broad alt selloff, HBAR flushed into the 0.07s and instantly got bought back, and according to industry sources the project is still on the radar for enterprise and tokenization plays, so the market clearly defended those lows.

On the 4H chart we’ve got a sharp V-reversal from the 0.075 area, huge volume, and RSI has ripped out of oversold to around 60. Price is reclaiming the main volume node near 0.09, aiming straight at the first thick supply zone around 0.098-0.105. With that combo I’m leaning toward a short term long bounce instead of fresh lows.

My base case: while HBAR holds above 0.088-0.089, I’m looking for a move to 0.10 first, with extension toward 0.104-0.107 where I’d start unloading longs. I’m stalking entries on dips into 0.09 with a tight invalidation under 0.088. If that support cracks and we close back under the volume cluster, this turns into a failed bounce and opens the door back to 0.08 - I might be wrong, but the current bounce setup looks too juicy to ignore. ✅

DeGRAM | HBARUSD is above the $0.1 level📊 Technical Analysis

● Price broke out of a falling triangle formation and has been consolidating at support, which strengthens the argument for an upward move. The support line near 0.075–0.078 provides a solid base for a potential rise.

● A break above the resistance line at 0.100–0.103 should lead to further upside toward 0.110–0.112.

💡 Fundamental Analysis

● A positive macroeconomic outlook for crypto adoption and ongoing network developments for HBAR can support medium-term price appreciation.

✨ Summary

Break above 0.103 targets 0.110–0.112. Long positions favored above 0.078 support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Hedera (HBAR): Waiting For Break of Structure (BOS) | BULLISHWe are bullish as soon as we hit that BOS near the local EMAs, which will confirm our buy-side trading setup.

Now there is one thing that concerns us, that being the huge CME gap below our local lows on current timeframes, so it is very important here to wait for that BOS before entering into long here, so let's wait.

Swallow Academy

Hedera (HBAR): Looking For Break of Structure (BOS)Hedera is strong where we are seeing a strong upside trend, which might be breaking the local high area (the resistance). As soon as we see it, we are going to look for proper BOS near that area where we will set out a long position.

Now bear in mind, RSI is heavily overbought so we might see some sideways movement or even a proper rejection before that so let's wait patiently.

Swallow Academy

HBAR 1D: Weekly Support Sweep+Wedge Breakdown — Reclaim to 0.2 ?HBAR just lost a major weekly level, but the selloff is still structured: price is sliding inside a tight descending wedge / channel on the daily.

When the market breaks a weekly support like this, I’m not looking to “buy cheap” — I’m looking for a sweep + reclaim.

What price is likely doing here

• Breaking the weekly floor to trigger stops / panic selling

• Walking price down along the wedge (controlled sell pressure)

• Setting up a spot where sellers get trapped if the reclaim hits

The setup I want (Price Action trigger)

1) Tag the wedge base

• I want to see a hard rejection (long lower wick, strong close off the lows)

2) Reclaim the broken weekly level (key)

• A daily close back above that level, followed by a hold on retest

• That’s the moment the breakdown turns into a bear trap

3) Break the wedge top

• Once price breaks the upper trendline, the move usually accelerates (shorts cover + new longs)

Targets if the reclaim confirms

• First objective: back to the breakdown origin (range recovery)

• Next: 0.20 becomes the magnet if momentum flips and structure starts printing higher lows

Invalidation (keep it simple)

• If price keeps accepting below the weekly level and rejects every retest from underneath → continuation lower until a real reclaim shows up.

My plan

I’m not catching the knife.

I’m waiting for rejection at the wedge base + reclaim — that’s the clean PA confirmation that sellers are losing control.

HBAR Breakdown or Bounce? This Zone Decides EverythingYello Paradisers, did you see that perfect tap into our key demand zone? After a prolonged move inside the descending channel, #HBAR has finally reached a critical decision point, and what happens next could define the mid-term trend.

💎#HBARUSDT has been respecting the descending resistance and support flawlessly, but now we’re seeing the first signs of a potential reversal forming right at the confluence of the demand zone and the major support area. This is where real opportunities are born, but also where inexperienced traders often get wrecked by jumping in too early or without confirmation.

💎If buyers step in with strength here and push through the descending resistance, the next upside target sits near $0.11291. Beyond that, we’re eyeing the strong resistance at $0.15125, which would complete a textbook breakout from the current structure. But until then, this is still a reactionary zone, not a confirmed trend shift.

💎A failure to hold above $0.085 would weaken the setup, and any move below 0.070 would completely invalidate the bullish scenario, opening room for further downside. This is why discipline is everything here. No need to rush. The real money is made waiting for the clearest signal, not forcing it.

Patience is key now. This is a moment where discipline will separate the pros from the crowd.

MyCryptoParadise

iFeel the success🌴

DeGRAM | HBARUSD exited from the triangle formation📊 Technical Analysis

● HBAR/USD continues to trade within a well-defined descending channel, with price repeatedly rejected from the dynamic resistance line, confirming sustained bearish control.

● The latest triangle consolidation near 0.12 resolved to the downside, projecting a continuation move toward the major horizontal support zone around 0.10–0.09.

💡 Fundamental Analysis

● Weak broader altcoin momentum and lack of strong ecosystem catalysts keep downside pressure intact as capital remains selective in risk-off conditions.

✨ Summary

● Price remains capped below descending resistance.

● A medium-term decline toward 0.10–0.09 is favored while below 0.125.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!