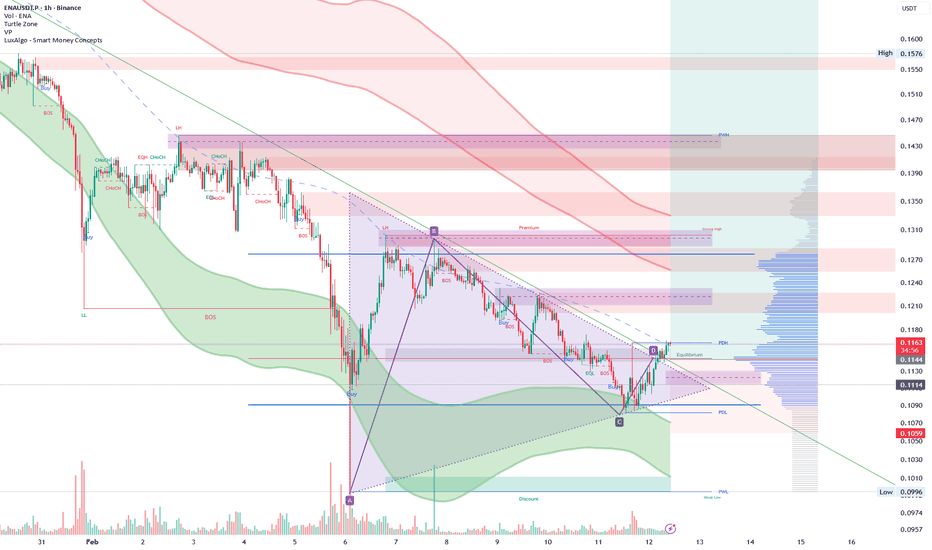

ENAUSDT.P – Long from Discount After Liquidity SweepENA swept sell-side liquidity into the PDL zone and reacted strongly from higher timeframe demand.

Price is now reclaiming internal structure and trading around the equilibrium of the current range. I’m positioning long, anticipating a move back toward premium liquidity.

🔹 Entry: 0.114–0.116

🔹 Sto

Related pairs

#ENA/USDT setting up for its next leg higher.#ENA

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upw

#ENA #Crypto #Altcoins #TechnicalAnalysis #SwingTrade #BinanceENA/USDT – Weekly Timeframe | Positioned at Major Demand

ENA is currently trading at a critical weekly demand zone, aligning with previous structural support. Price action suggests the asset is approaching a potential exhaustion phase following a prolonged corrective cycle.

Current Price: 0.12 USD

ENA: is this the moment to buy? key levels and targets aheadENA. Thinking this thing is dead, or is the crowd just giving up at the worst moment? According to industry sources, yield and restaking tokens have been under pressure again after fresh headlines about tighter oversight and cooling demand, and ENA has been sold with the rest of the basket. On the 4

Weekly Down-Channel: Support Rebound Play ?ENA/USDT is trading at the lower boundary of a well-respected weekly descending channel. This area acts as dynamic support, so the primary idea is a controlled rebound toward the channel midline first, and potentially the upper boundary if momentum follows. Confirmation comes from strong rejection w

ENA / USDT — Daily Update (Follow-up)Price kept respecting the bearish structure after the previous update.

The rejection at the trendline confirmed sellers are still in control and the market moved back into the lower range.

Current situation

Local support: 0.095 – 0.115

Mid level to reclaim: 0.131

Key S/R flip: ~0.20

Still trading

ENA / USDT – Daily OutlookENA remains in a bearish higher timeframe structure, continuing to respect the descending daily trendline.

Price is still forming lower highs and lower lows, indicating no confirmed trend reversal.

The previous daily support has been cleanly broken and is now acting as resistance.

Market Structure

Is $ENA Ready for a Bullish Move?BINANCE:ENAUSDT is retracing into a well-defined demand zone at $0.1667–$0.1652, where price previously formed higher lows and showed strong buyer absorption. The recent impulsive move confirms demand-side strength, keeping market structure bullish and favoring continuation toward liquidity highs.

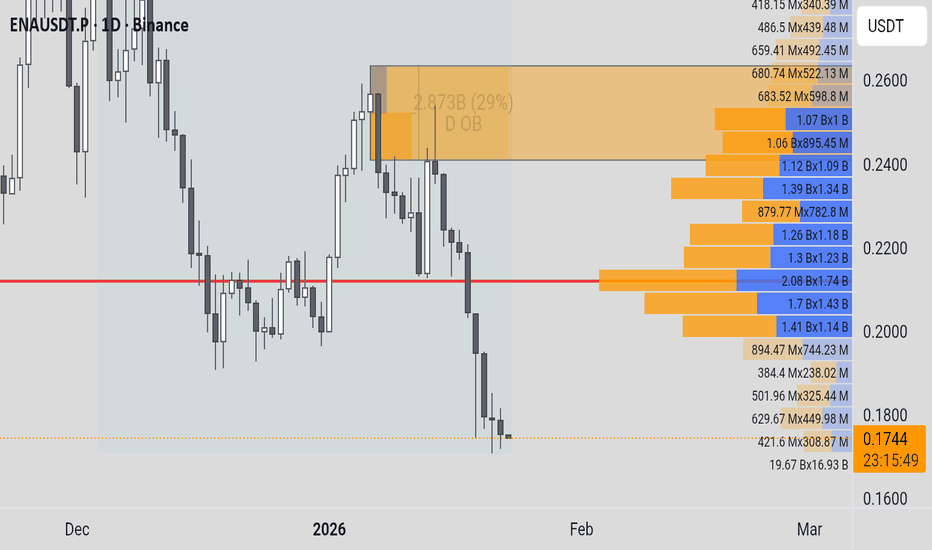

ENA / USDT: Reclaiming the Floor or Further Capitulation?Market Context

ENA has recently undergone a sharp correction after being rejected from the Daily Order Block (D OB) located between 0.2400 and 0.2600. The price has now dropped below its previous swing low (marked by the dashed pink line) and is currently hovering near 0.1746, searching for a new b

#ENA/USDT setting up for its next leg higher.#ENA

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upw

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Ethena/USDT (ENA) is 0.1147 USDT — it has fallen −4.98% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing ENA price chart.

Ethena/USDT price has fallen by −0.09% over the last week, its month performance shows a −43.88% decrease, and as for the last year, Ethena/USDT has decreased by −83.30%. See more dynamics on ENA price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

Ethena/USDT (ENA) reached its highest price on Sep 17, 2025 — it amounted to 0.7218 USDT. Find more insights on the ENA price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

Ethena/USDT (ENA) reached the lowest price of 0.0998 USDT on Feb 6, 2026. View more Ethena/USDT dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying ENA is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade ENA right from TradingView charts — just choose a broker and connect to your account.

Ethena/USDT (ENA) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, Ethena/USDT is estimated as 6.92% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about Ethena/USDT, you can find more inspiration in our curated watchlists.

You can discuss Ethena/USDT (ENA) with other users in our public chats, Minds or in the comments to Ideas.