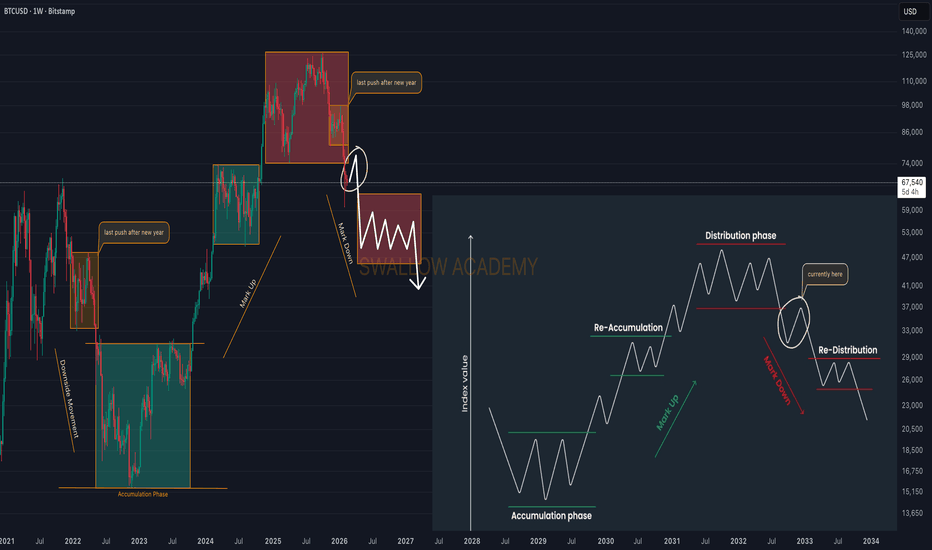

Btc and the midterm election cycles2026 sees the midterm election over in the USA, these midterms seem to have an adverse effect on the bitcoin price as you can see from what I've drawn.

I've looked back to the last 2 midterms, 2018 and 2022 and both have the same conclusion, large drawdowns. 2018 saw an 84% price decrease on bitcoi

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

BITCOIN MACRO UPDATE LIFE CYCLE, STRUCTURE & PRICE LEVELSIt is timely to revisit the typical crypto market cycle, as Bitcoin continues to respect it with remarkable precision.

The macro top was confirmed in October, when BTC tested the $126,000 zone, marking the current cycle ATH. Since that rejection, price has transitioned into a prolonged consolidat

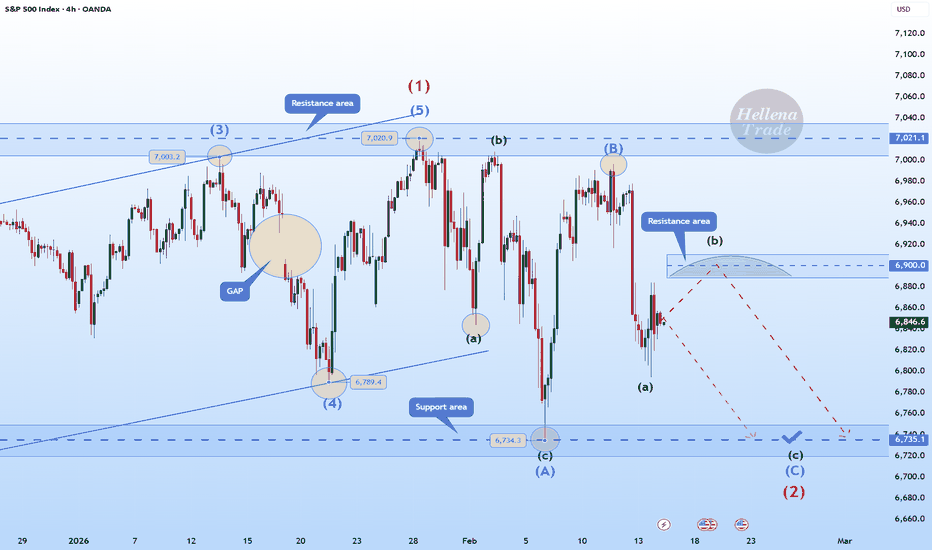

Hellena | SPX500 (4H): SHORT to support area of 6735.Colleagues, it seems that we are facing a combined correction, which means that wave “2” is not yet complete and we should expect a price decline to the support area of 6735, where I think we should take profits.

As part of a small “abc” correction, it is possible to reach the 6900 area before the

Bitcoin: 80% 80K Price Objective. While the Broader structure is pointing bearish, recent consolidation after testing the 60K area support suggests a potential bullish retrace with an 80K price objective. There are 3 key support areas or "order blocks" to be aware of. The 59K to 60K (weekly) and the 66K to 68K area where price is fl

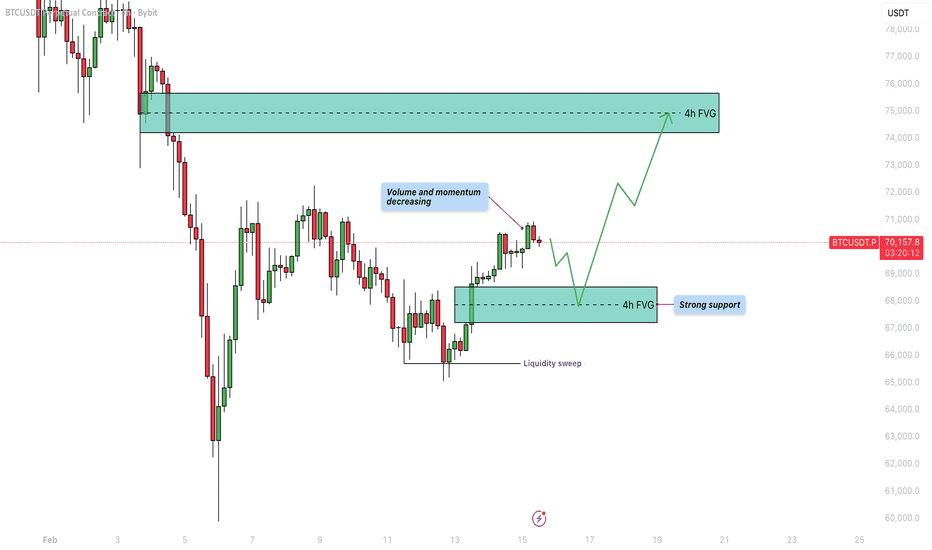

Bitcoin - Small correction before a big move upBitcoin is currently trading around $70,000 after recovering from a recent low. The market structure on the 4-hour timeframe shows a clear reaction from a liquidity event followed by a controlled move higher. However, price is now approaching a decision point as momentum begins to slow. The interact

NVDA - Techs Fail and Insiders BailThis chart looks ugly for the bulls. That red trendline has been holding the price up for months, but now it is finally giving way. When a major support level like this cracks, it usually means the uptrend is over and we are heading lower.

But the real red flag is what the leadership is doing.

Ins

Nvidia May Be RangeboundNvidia has gone nowhere since October, and some traders may think the AI giant is rangebound.

The first pattern on today’s chart is the December 26 high of $192.69. NVDA probed that level in late January and again this month without breaking out. That may suggest that resistance is in place.

Secon

Nasdaq Crash Incoming: Wave 3 of 3 DownOver in this video, I go through the 5th wave up and identify 2 key things for this top:

1. Wave 5 = Wave 3, since wave 1 is the longest, wave 3 cannot be the shortest wave.

2. 2 Spinning tops marks the peak on 29th and 30th Oct 2025.

The first wave down is a "leading diagonal" because wave 4 overl

Bitcoin flashing traditional accumulation signals (alt season?)TL:DR

Bitcoin is finding a bottom but probably still has some downside. Strong hand are probably accumulating Bitcoin and especially alts.

Introduction

Bitcoin is flashing multiple accumulation signals. But this downtrend has been so gradual and lacking in volatility it barely feels like a bea

Bitcoin: Is the WXYXZ Correction Setting Up Wave C?Bitcoin: Is the WXYXZ Correction Setting Up Wave C?

During the last 5 days BTC declined by nearly 5% from 72250 to 65170

Looks like the B wave has more a corrective movement and is expanding as WXYXZ pattern. If the price manages to move above the previous X near 68300 it will add the chances t

See all editors' picks ideas

MovingAveragesLibrary "MovingAverages"

A collection of O(1) numerically stable moving averages that support anchors and fractional lengths up to 100k bars.

Pine Script has a robust set of moving averages suitable for a majority of cases, making these alternatives useful only if you need anchoring, fractional

Clusters Volume Profile [LuxAlgo]The Clusters Volume Profile indicator utilizes K-Means clustering to categorize historical price action into distinct groups and generates individual volume profiles for each detected cluster. This tool provides a unique perspective on volume distribution by isolating price behaviors based on prox

Central Bank Liquidity Gap IndicatorThis indicator measures the gap between global liquidity growth and stock market growth to identify potential buying opportunities.

Liquidity drives markets. When central banks print money, that liquidity eventually flows into stocks and other assets. If we spot when liquidity growth is outpacing

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

See all indicators and strategies

Community trends

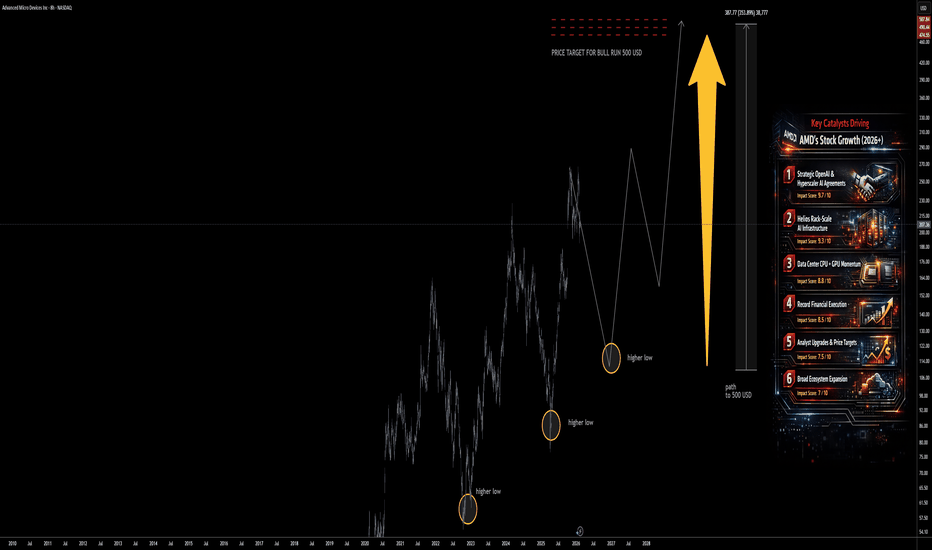

AMD (2026+) Catalysts & Risks: 500 USD PT Bulls🟥 AMD (2025+) Catalysts & Risks: Analyst Views (Updated 2026)

🔑 Key Catalysts Driving AMD’s Stock Growth (2026+)

🌌 Strategic OpenAI & Hyperscaler AI Partnerships

AMD has moved beyond “potential contender” into real hyperscaler deployment territory, with major multi-year AI infrastructure commitme

Tesla - Not the final breakout yet!🎯Tesla ( NASDAQ:TSLA ) is still in breakout mode:

🔎Analysis summary:

Just recently, Tesla broke out of a significant bullish triangle pattern. But looking at the higher timeframe, this triangle breakout is still not really confirmed yet. Instead, Tesla has to create new all time highs soon in

PALANTIR Bear Cycle accelerating. Potential bottom at $43.Palantir (PLTR) was one of the biggest winners of the 2023 - 2025 A.I. driven Bull Cycle but since breaking below its 1W MA50 (blue trend-line) two weeks ago, it has confirmed its new Bear Cycle.

So far this is no different than the previous one in late 2021 - 2022. That Bear Cycle also started whe

FNMA Fannie Mae Daily SupportFNMA Daily Chart

Currently at a technical support area with a daily pin bar,

and weekly pin bar right now but there is still 3 days to go and this could easily change

I actually expect this to get to $17 or so before hitting any long term resistance/ trend lines pre GFC

There is a completed ellio

Small, quick trades get a bad rap - this one is a good RAPP.This is a newer system I've been using for about a week now, though I've backtested it on almost 3000 trades at this point and it's done magnificently. I use proprietary indicators for both signals and price targets, but the blue arrows on the chart show what the signals have generated since Octobe

Booz Allen Hamilton Holding Corp | BAH | Long at $76.60Technical Analysis

Booz Allen Hamilton Holding Corp NYSE:BAH has officially dipped into my selected "crash" simple moving average zone. While the base of this zone is currently at $71, I am not super confident it will hold here. The "major crash" simple moving average area is currently betwee

See all stocks ideas

Today

FVRRFiverr International Ltd.

Actual

0.86

USD

Estimate

0.74

USD

Today

FDPFresh Del Monte Produce, Inc.

Actual

0.70

USD

Estimate

0.28

USD

Today

CSTMConstellium SE

Actual

0.71

USD

Estimate

0.34

USD

Today

GLBEGlobal-E Online Ltd.

Actual

0.35

USD

Estimate

0.31

USD

Today

CAMTCamtek Ltd.

Actual

0.81

USD

Estimate

0.81

USD

Today

NPOEnpro Inc.

Actual

1.99

USD

Estimate

1.91

USD

Today

DINOHF Sinclair Corporation

Actual

1.20

USD

Estimate

0.45

USD

Today

TNLTravel Leisure Co.

Actual

1.83

USD

Estimate

1.81

USD

See more events

Community trends

BITCOIN MACRO UPDATE LIFE CYCLE, STRUCTURE & PRICE LEVELSIt is timely to revisit the typical crypto market cycle, as Bitcoin continues to respect it with remarkable precision.

The macro top was confirmed in October, when BTC tested the $126,000 zone, marking the current cycle ATH. Since that rejection, price has transitioned into a prolonged consolidat

Bitcoin - All ETF investors will get liquidated! (here is why)Bitcoin can drop below 40k later this year! But before that, in the short term, we may see a final drop to 58k, followed by a huge bear market rally to 85k. If you are confused, let's take a look at my prediction:

Short-term: 58k (wave A on the chart)

Mid-term: 85k (wave B on the chart)

Long-te

Bitcoin (BTC): Wyckoff Is Telling Us Of Upcoming Big DumpNot a first time we've been looking at the wyckoff structure but since the last time we looked, we had a nice break of the neckline (a major signal of trend reversal).

If we were to base our predictions on Wyckoff structure development, we should soon see a smaller recovery and then another bigger

Hype (Hypeusdt): two head and shoulders are formingHi!

Price is showing two structural signals. The smaller purple head & shoulders has already broken its neckline, which activates the measured move and increases the probability of the price moving toward the projected downside target.

The larger blue head & shoulders is still developing and not f

ETH Holding Major Support – 2040 Reclaim Opens Path to 2090ETH Holding Major Support – 2040 Reclaim Opens Path to 2090

ETH is reacting strongly from a well-defined support zone around 1935–1950, which has now been defended multiple times.

The repeated wicks into this area show clear buyer interest and absorption after the sharp sell-off from the highs.

LINK – Weekly Support in PlayLINK is now diving into a major weekly support zone , the same area that previously acted as accumulation.

This is a key level.

As long as this weekly support holds , we will be looking for long-term longs, positioning for the next potential upside cycle.

However , for the bulls to truly take o

BTCUSDT Sellers Defend 69,500, Downside Still in PlayHello traders! Here’s my technical outlook on BTCUSDT (2H) based on the current chart structure visible on the screenshot. BTCUSDT has been trading within a broader bearish environment following a strong sell-off from the highs, where price consistently printed lower highs and lower lows. This decli

Alerts on TradingViewAlerts are most effective when they prepare decisions rather than provoke them. Many traders treat alerts as entry signals. When a notification fires, they rush to execute, skip validation, and react emotionally to price movement. A disciplined approach uses alerts as filters. Their role is to narro

BITCOIN The 0.382 Fibonacci consolidation rule.We have already shown on various recent analyses how Bitcoin (BTCUSD) is replicating the Bear Cycle of 2022. Our latest finding is a very unique feat that BTC does after every major Low.

As this chart shows, when the 1W RSI turns oversold (below 30.00), Bitcoin starts a lengthy consolidation that e

BTCUSDT: Coiling for Move - Bearish Bias While Below 70KHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT has been trading within a well-defined bearish environment, moving inside a descending channel where price consistently formed lower highs and lower lows. This structure reflected controlled selling pressur

See all crypto ideas

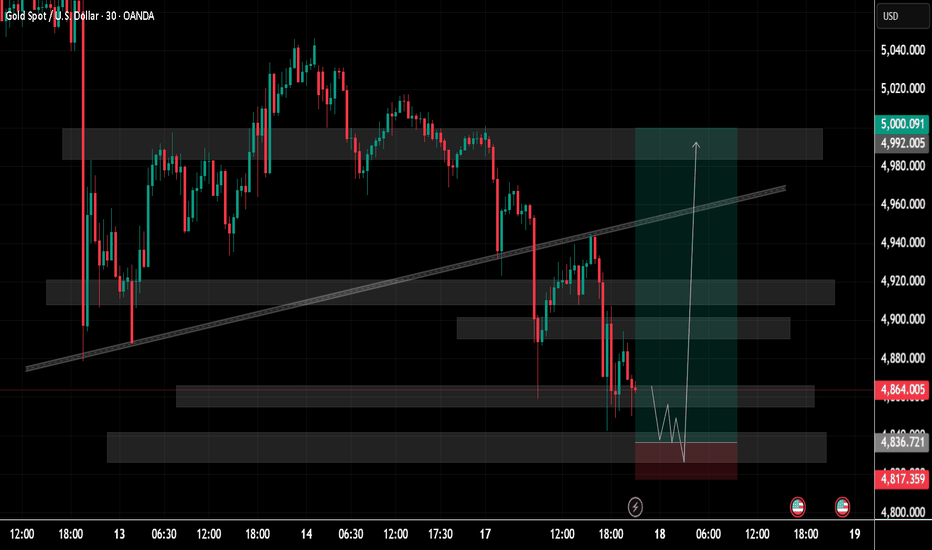

Gold 30Min Engaged ( Bearish Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 4940 Area

Gold next move (expecting sell)(18-02-2026)Plz Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (18-02-2026)

Current price- 4960

"if Price stays below 4990-95 then next target is 4940, 4900, 4850 and 4760 and above that 5020 and 5100".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSS

XAUUSD Long: Demand Support Signals Potential Upside To 5,000Hello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold was previously trading within a well-defined ascending channel, where price consistently respected both the dynamic support and resistance boundaries. This structure reflected strong buyer control an

GOLD - Declining demand led to a correction FX:XAUUSD remains under moderate pressure, staying below the key level of $5,000. The market is awaiting news on the US-Iran negotiations, which will be the immediate driver.

There is a lack of demand from Asia due to the Chinese New Year celebrations. The USD is up slightly amid portfolio reb

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Yesterday we gave the level of 4920 which is where we wanted price to RIP and give us a long trade into the higher level to complete the pattern test and then make its way back. We managed to get the level, we managed to get the bounce, however, it was short

#XAUUSD: 1500+ Intraday Trading Idea, Let's See How It GoesDear Traders,

Gold has been declining since market opening at 4950. We believe the price is likely to continue falling around $4700 which is a strong indication.

Please exercise risk management while trading gold and consider using small target sizes initially such as 300 pips before increasing th

XAU/USD | Gold Rejected Hard From Supply, Heavy Drop Ahead ?By analyzing the #Gold chart on the 1-hour timeframe, we can see that price moved exactly as expected and entered the $5038 to $5077 supply zone. Once Gold reached this area, it faced aggressive selling pressure and experienced a sharp decline down to the $4859 level.

After tapping into that demand

XAUUSD: Bullish Structure Holds - Buyers Target 5,110 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish environment after a strong impulsive advance earlier in the structure. This initial rally was supported by a clearly defined upward channel, confirming strong buyer control

GOLD Price Update – Clean & Clear ExplanationGold is trading under sustained bearish pressure after breaking below a rising trendline and key intraday support levels. Price action shows a clear shift in structure from higher highs to lower highs, confirming short-term downside momentum.

The recent selloff pushed gold into a strong demand zon

XAU/USD Bearish Continuation Towards lower Support levelsGold is showing strong bearish momentum after rejecting the upper resistance zone and breaking below the rising trendline support. Price failed to sustain above the key supply area near 4,960–4,980, leading to aggressive selling pressure. The structure now reflects lower highs and lower lows, confir

See all futures ideas

AUDUSD Monthly CLS - Model 1 Hi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

GBP/USD Channel + Resistance Rejection (17.02.2026)📊 Description✅ Setup FPMARKETS:GBPUSD

GBPUSD is trading inside a descending channel, respecting the trendline structure.

Price recently tapped a key resistance zone near the channel top and showed rejection.

Confluences:

✔ Descending channel structure

✔ Clear resistance zone reaction

✔ Price be

GBP/USD – The Distribution Has Already StartedOver the past sessions, I’ve been closely monitoring GBP/USD, and the recent price action suggests the market may be transitioning from bullish expansion into a distribution phase. After the impulsive rally toward the 1.38 region, continuation signals have weakened, and price is now struggling to ma

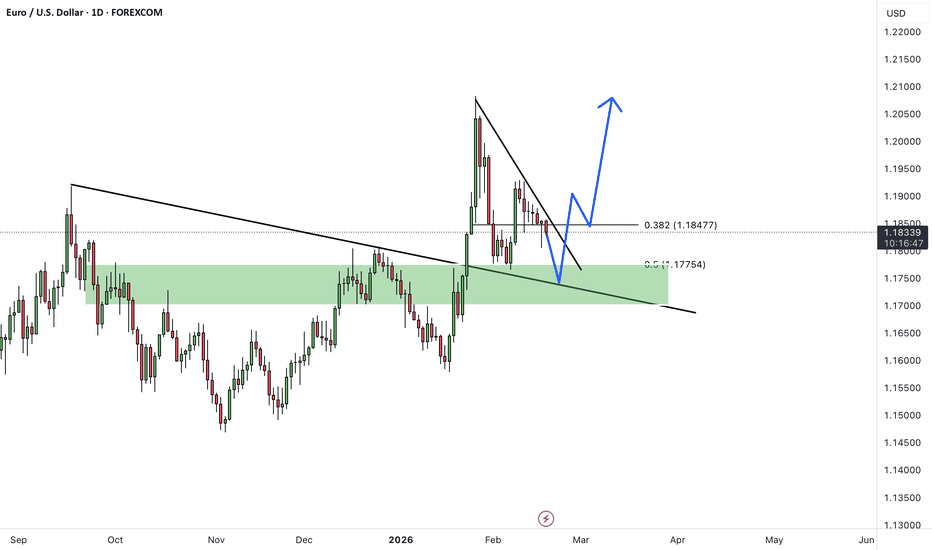

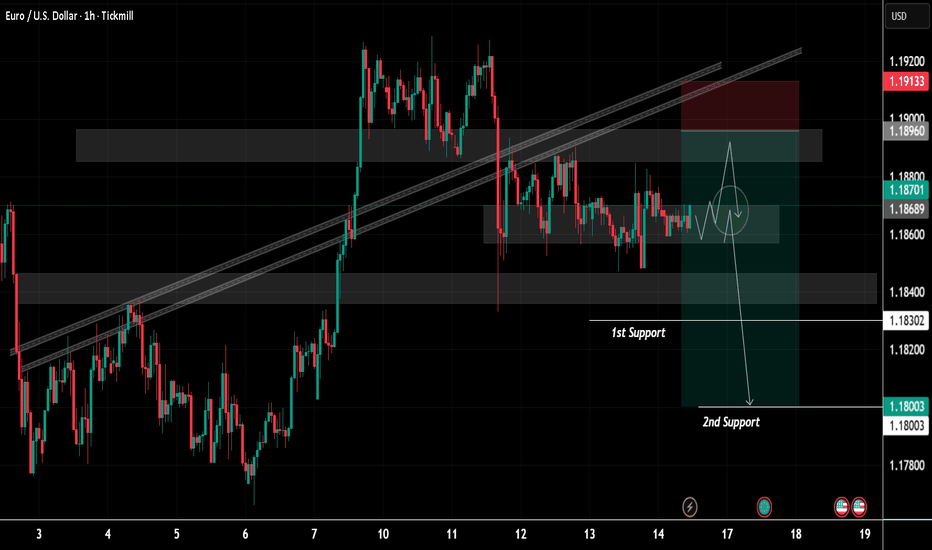

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

The price has successfully broken above a long-term descending trendline and a major resistance zone, confirming a structural bullish shift in the higher timeframe.

After reaching the recent swing high, the pair entered a healthy corrective phase

GBPJPY Pullback Into Value Zone Volatility High, Structure StillGBPJPY Pullback Into Value Zone — Volatility High, Structure Still Alive

After a sharp unwind, GBPJPY has slammed into a key support band and is now trying to stabilize. The move down has been fast and emotional rather than orderly, which usually tells me this is more about positioning flush and ye

NZDUSD: Bullish scenario above 0.6020NZDUSD: Bullish scenario above 0.6020

NZDUSD is respecting a well-defined demand zone around 0.6020, where price has already reacted twice, confirming short-term buyer interest.

The structure on the 1H timeframe shows consolidation after a sharp rejection from the 0.6070 area, followed by higher

EURUSD Price Update – Clean & Clear ExplanationEUR/USD is currently trading around 1.1864, moving within a short-term consolidation phase after a strong bullish rally earlier in the week. Price initially broke above the ascending channel but failed to sustain momentum, leading to a sharp pullback and a transition into sideways movement.

The EUR

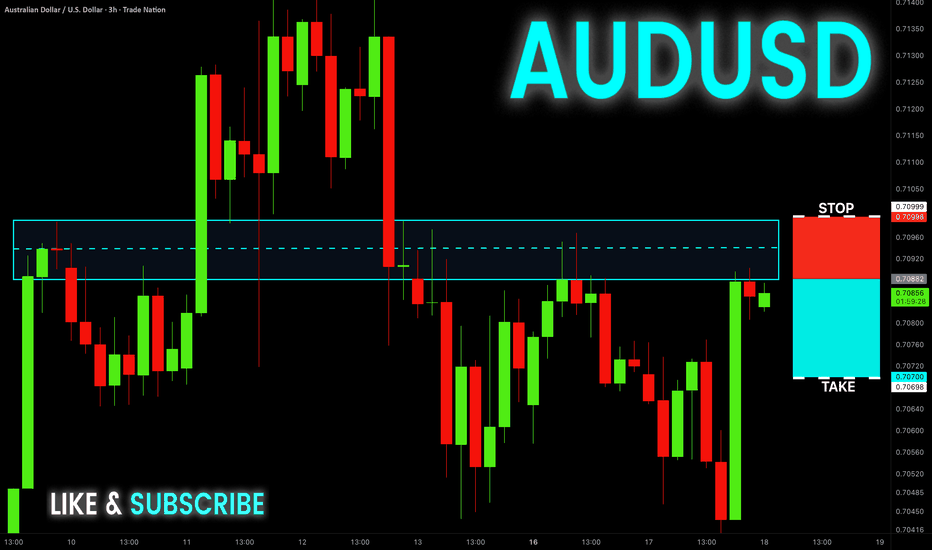

AUD-USD Free Signal! Sell!

Hello,Traders!

AUDUSD swept buy-side liquidity into a strong supply area and formed bearish displacement from premium zone. Expect continuation toward internal sell-side liquidity.

--------------------

Stop Loss: 0.7099

Take Profit: 0.7070

Entry: 0.7088

Time Frame: 3H

--------------------

Sell!

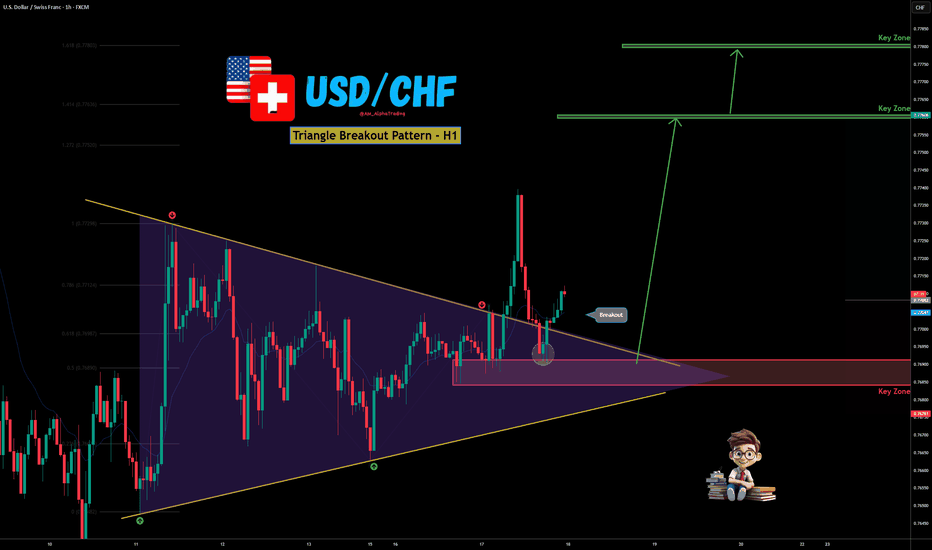

USD/CHF Triangle Breakout on H1 – Bullish Expansion Loading?📊 USD/CHF – H1 Technical Outlook

✅USD/CHF has formed a clear symmetrical triangle on the H1 timeframe, showing prolonged consolidation and price compression. After multiple rejections from descending resistance and higher lows building at support, price has now broken above the upper trendline — s

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.